Leveraging Post-Purchase Surveys to Optimize Your Subscription Program

Attribution is one of the most contentious topics in marketing today. Plenty of tools have tried to solve for it, but ultimately one of the most effective ways to find out how someone ended up on your store is just to ask them. That’s where the post-purchase survey comes in.

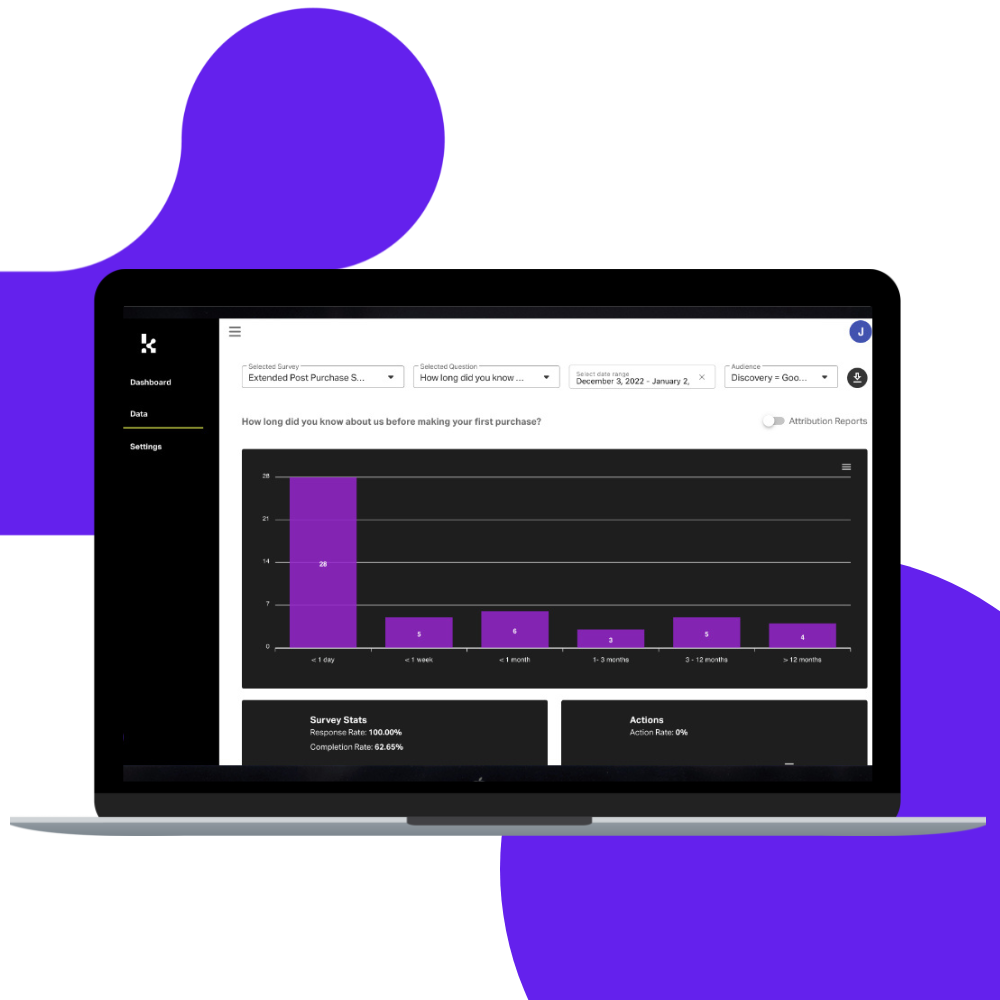

But these surveys can tell you way more than where shoppers came from. With the right strategy, you can find out any number of things that could be impactful to your business, from how you acquire customers and how to keep them, to how long they considered the purchase before clicking Buy.

There are a few ways PPS can be particularly helpful for subscription-focused brands. We sat down with Jeremiah Prummer, CEO of KnoCommerce, to get some of his expert insight on using post purchase surveys to boost your subscription program.

Q: Thanks for hanging out with the Stay team today, Jeremiah! Let’s start out with a question you probably answer all the time: What’s so valuable about a post-purchase survey?

Jeremiah: Of course! Post-purchase surveys give customers the ability to tell you things like:

– Why customers purchased

– What made them want to buy

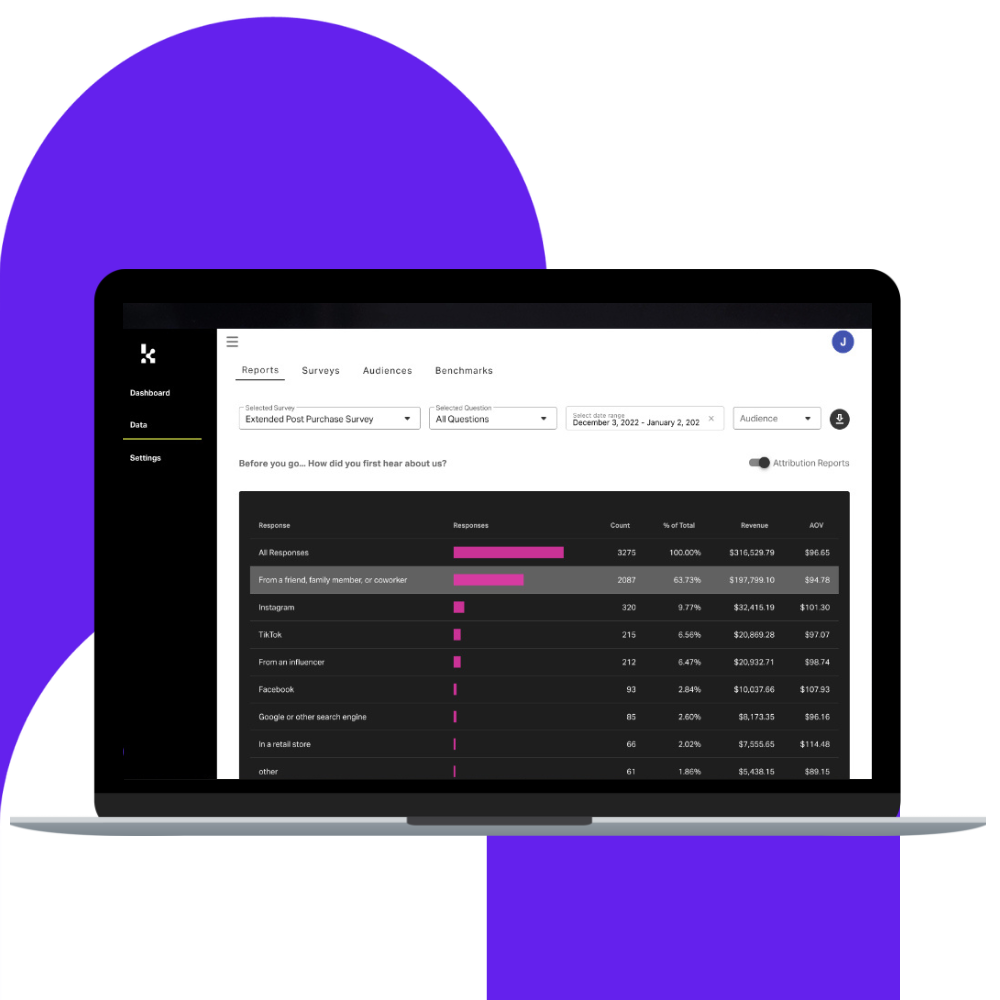

– Where they remember discovering your brand

So they can be really valuable in determining what’s actually driving initial awareness. Then, understanding why people buy makes it easier to resonate with the right customers.

Q: So, are post-purchase surveys solving the attribution problem?

Jeremiah: They can certainly help. The reality is, tracking discovery is extremely challenging. Think about what happens when someone sees your ad: What are they doing? What’s the psychology behind that?

On a platform like TikTok or YouTube, they’re in entertainment mode. They’re probably not going to stop what they’re doing to click on your ad and go buy something. Without PPS, your attribution data will often miss a lot of the value these top-of-funnel channels actually bring.

Q: Can you give a few examples of how to use post-purchase surveys in subscription specifically?

Jeremiah: Totally. One simple one: product research. Your subscribers are regular purchasers. They obviously like your products. These buyers could be great targets for questions around what other types of products they might like to see from you.

Another one: subscriber motivation. If it’s a first-time customer with a subscription order, you might ask them why they decided to subscribe. (You could also survey customers who didn’t subscribe, to find out why and then potentially push them towards subscription later.)

Third, offer optimization. If a subscriber is on order 3 and that’s a common churn point, find out how they’re feeling and if they’re getting what they need. You might find people are running out too soon, or that they have too much and you need to change delivery cadence.

Finally, you can splice the data to see differences between types of buyers, like comparing trends in discovery channel or purchase motivation between subscribers and one-off purchasers. For example, if you see that your longest tenured subscribers primarily come through organic, you probably won’t want to spend money on Google ads to push your subscription offer.

Q: Kno has grown super fast, so you’ve worked with a ton of brands already on this. What are the things you most frequently see brands get wrong when they’re setting up their post-purchase surveys?

Jeremiah: Typically, it comes down to either not sticking with survey questions long enough to see trends over time, or sticking with the same survey questions for too long.

Q: OK, that sounds really contradictory! Say more about that.

Jeremiah: Yeah, and that’s because it depends on what you’re actually looking for. If you want to understand in aggregate how your customers are discovering you, you want to ask the same question every time in a standardized way, because you’re looking for variances in that data.

On the other hand, if you want to understand why somebody is buying your product, you actually do want to change that question regularly. It’s nuanced, but the goal of the question is to dig deeper into the motivations and angles you might be missing.

If people are buying because they saw it on TV, you might want to dive deeper to figure out if it was a commercial or a product placement, or what channel they saw it on.

Q: So you would do that through follow-up questions, correct?

Jeremiah: Yeah, and we do find a lot of people only want to ask one question. But while you don’t want to ask too many questions, we find that people are actually super willing to answer more questions if they’re relevant. People are more willing to give you that data if you’re giving them something meaningful.

Q: Makes sense. Let’s talk about how to ask the questions, because the actual wording can be so impactful. What should brands know about this?

Jeremiah: Start with understanding what you’re trying to uncover, so you can be more specific in how you ask. In an attribution survey, you should be trying to uncover initial discovery.

You may also want to find out what actually made them buy today, and how long that journey was from discovery to purchase. But if you just ask ‘How did you hear about us?’ it doesn’t answer any of those questions.

Q: And then, what about in the answer options you provide? Does that requirement for specificity carry over?

Jeremiah: Not necessarily — it’s more important to narrow down your answer options, because too many can be overwhelming.

So for example, when you’re asking ‘How did you first hear about us?’ you wouldn’t include your email list as an option. Even if you want to know the impact of your email list, email is not actually a discovery point.

You also wouldn’t put items that are too alike, like Instagram feed and Instagram post and Instagram influencer. Just put Instagram, or just put Facebook. Make it really limited. Then you ask additional questions based on the response, so if somebody says Instagram you can ask ‘Who posted about us?’ to dive deeper.

Q: This has been super valuable, Jeremiah. Any final words to leave us with?

Jeremiah: Just that, you know, the cost to acquire a customer has gone up so much. That makes the retention piece so important. There’s a massive opportunity there to be able to generate revenue over time, especially when you have products people might want to rebuy every month or so.

And so while a lot of people think about using PPS to understand acquisition and attribution, there are a lot more use cases and things you can learn if you set up your program right.

You can find Jeremiah Prummer on LinkedIn and Twitter, or visit the KnoCommerce website to learn more about post purchase surveys and how Kno can help.