How to Get Your First 1,000 Subscribers

The early days of launching a business or introducing a subscription plan are some of the most exciting– and the most critical. You’re literally building the foundation for your brand, so you want to hit the ground running and bring in customers in a smart, scalable way. Having a specific milestone to work toward can help you stay focused and motivated, so here is your guide to getting your first 1,000 subscribers!

Fine-Tune Your Offering

Acquiring your first 1,000 subscribers is all about finding the right product/market fit and really dialing in your subscription offering. Here are some of the areas you should look at:

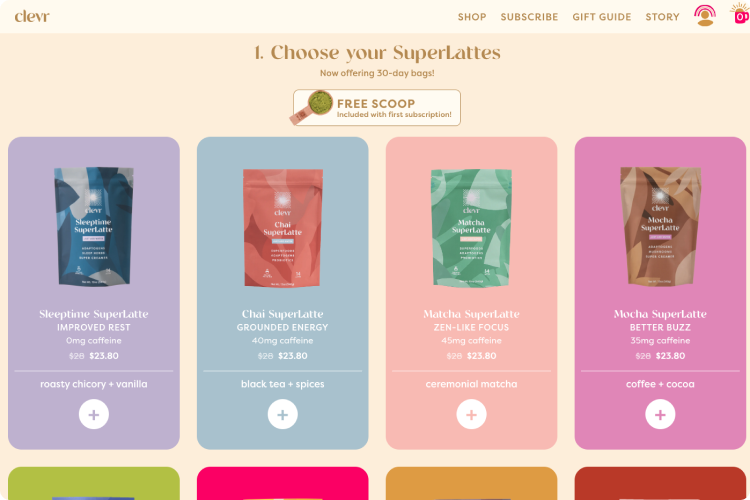

Structure: The structure of your subscription offering makes a big difference in securing consumer buy-in. How do your customers respond to different price points, products, and bundles? What’s the ideal structure for your target audience?

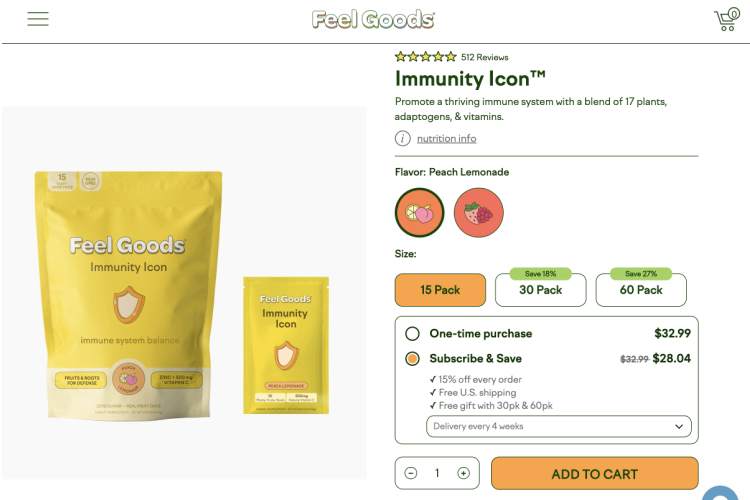

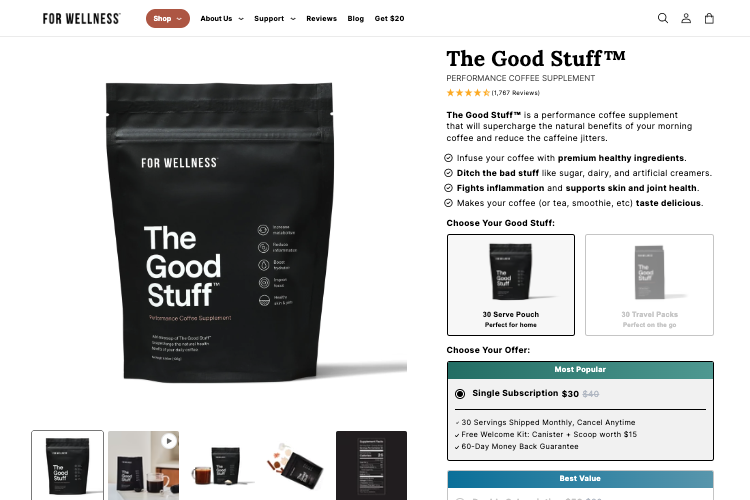

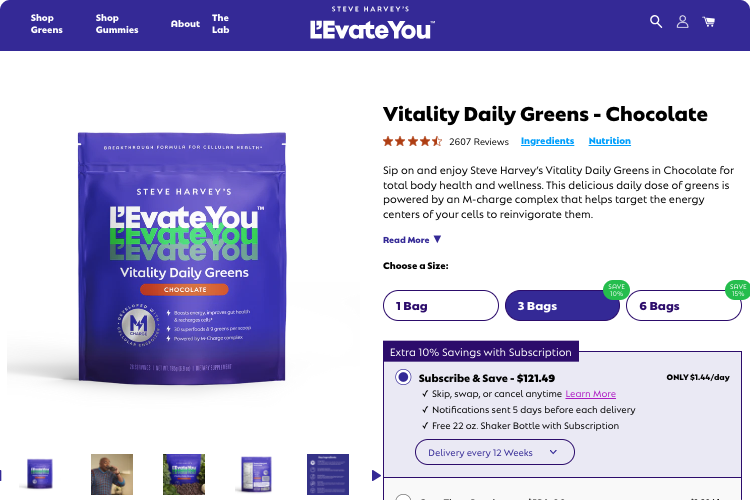

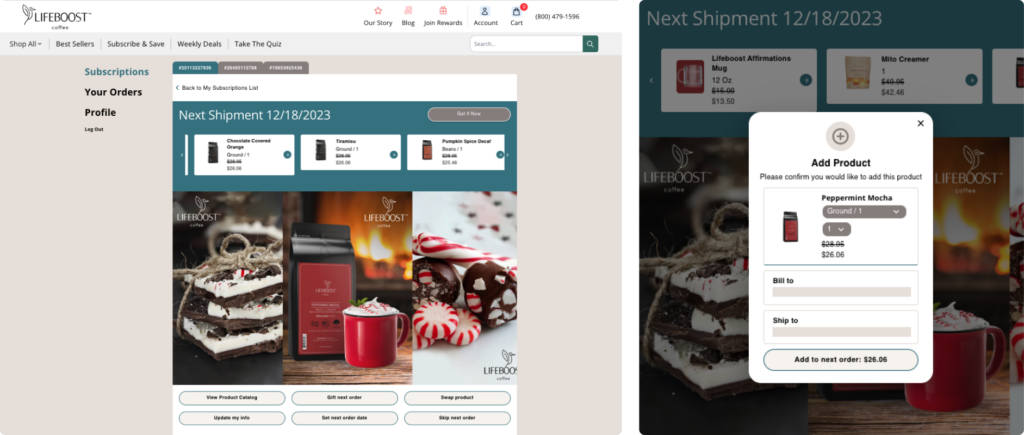

Usage Rate: Understanding the usage rate for your products is key to a successful subscription model. How much of a product does someone need for a given time period? When will they need another order? Answering these questions will help you understand the ideal order velocity. You can then fine-tune your customers’ options for scheduling their orders on the Stay Ai platform so your brand fits as seamlessly into their lives as possible.

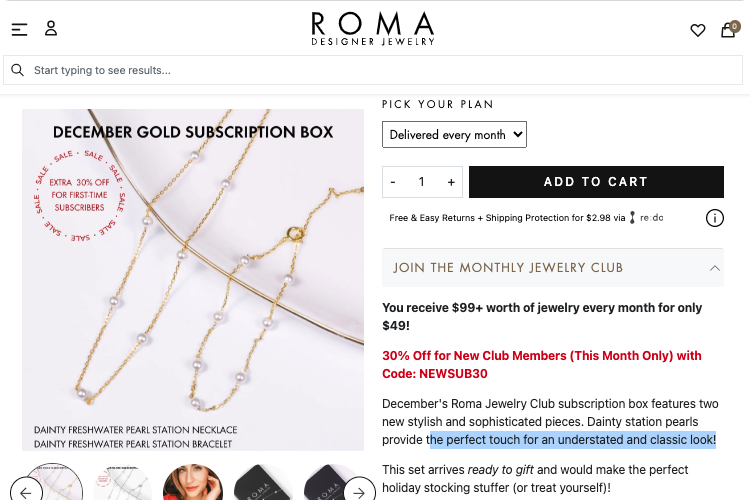

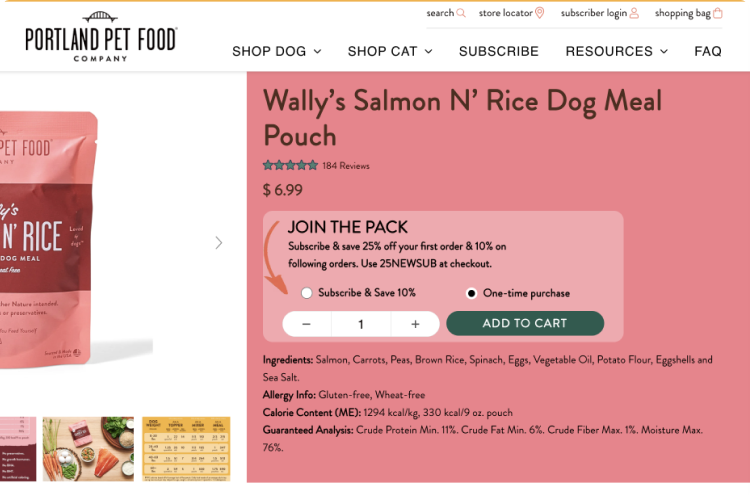

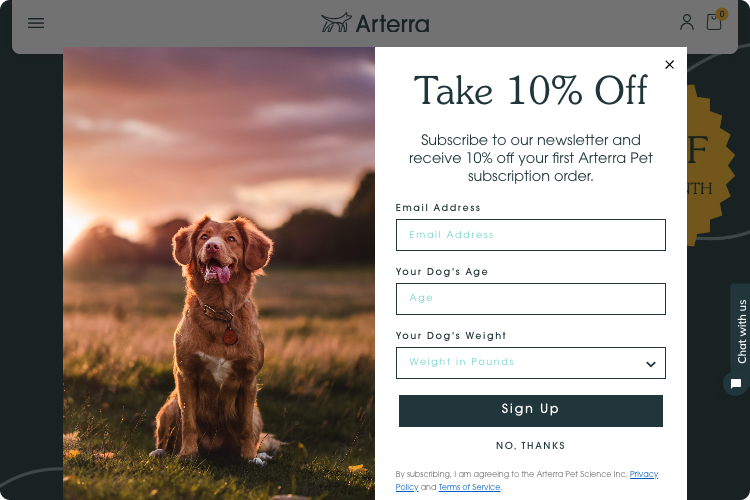

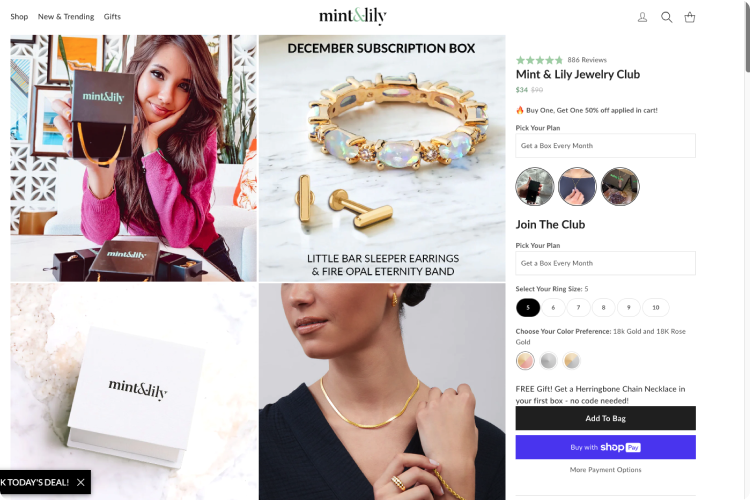

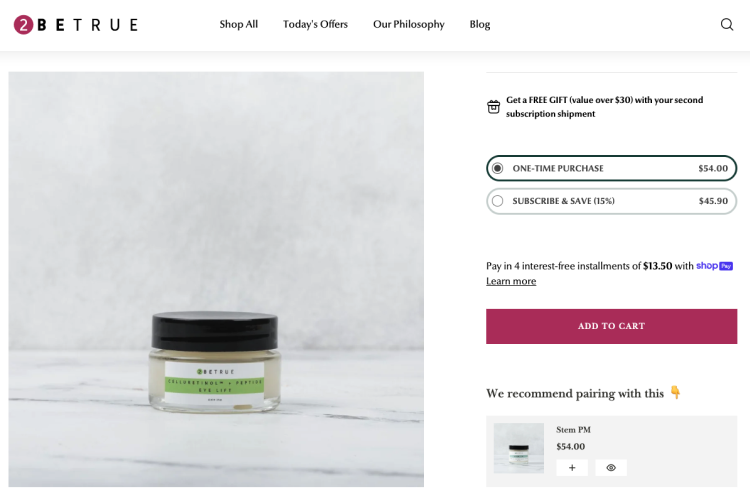

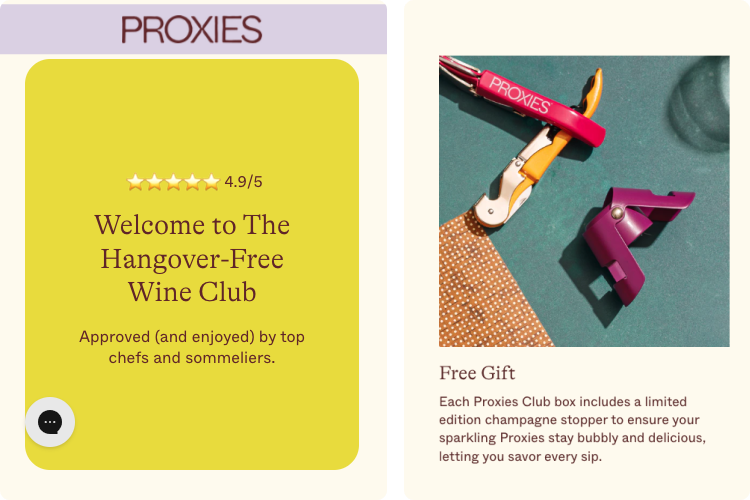

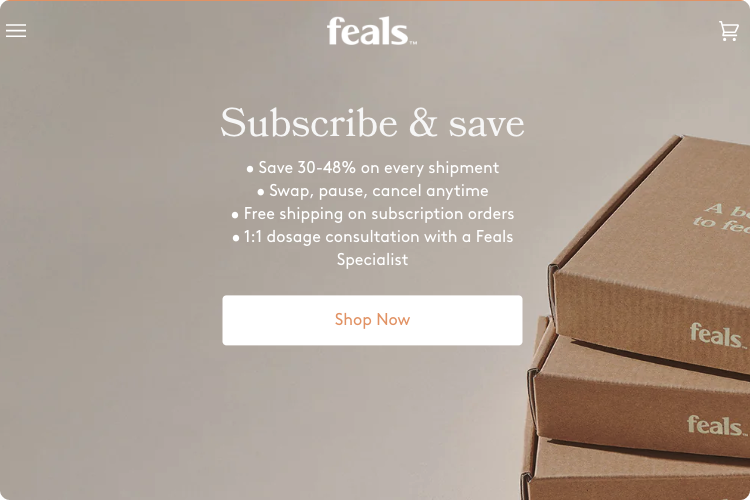

Entry Offers: When done well, entry offers are a great way to pick up new subscribers. The key is finding the promotional offering that will have the biggest impact. Whether it’s free shipping, a percentage off, or a lower-priced trial, different audiences will respond to different offerings, so it’s important to understand what your demographic will enjoy most. Run a few tests to see what drives the most engagement.

Messaging: Every audience is unique. What marketing messaging really resonates with your audience? What product value propositions and brand positioning are impactful?

Targeting: Understanding who you want to target and why will help guide your marketing strategy. Who are your ideal early adopters? How will you target them? How does changing the targeting criteria in a paid ads platform impact a cohort?

Friction Points: Figuring out the issues that prevent people from converting is vital. Is it the site experience, the price, the shipping, or another factor? How can you address those friction points to make the experience more streamlined?

Establish a Marketing Strategy

If you already have an established ecommerce business and are now working on adding a subscription option, you may think all you have to do is throw a subscription plan into the mix and people will flock to it. But while you’ll undoubtedly gain some subscribers just by launching the service on product pages, brands that have a marketing strategy to drive subscriptions are the most successful. For example, using unique landing pages that help steer new traffic down funnels that are specifically designed to convert them into subscriptions can make a big difference. Rather than passively hoping people will see your subscription program, be active and market your offering specifically.

Consider Your Channels

To acquire new subscribers, we recommend starting with one channel and mastering it before adding more to your marketing mix. That way, you can really dial in rather than trying to balance a complex strategy all at once. Facebook and Instagram make it easy to control your traffic by optimizing your audience. Influencers can also be a great acquisition channel once you’ve established a strong subscription offering. Just utilizing Facebook ads with rapid content testing, landing pages, and strong email/SMS automations customized through Stay Ai, you can build up to a significant monthly revenue. Then, when you’re ready to scale, you can start pulling other levers.

Analyze Data

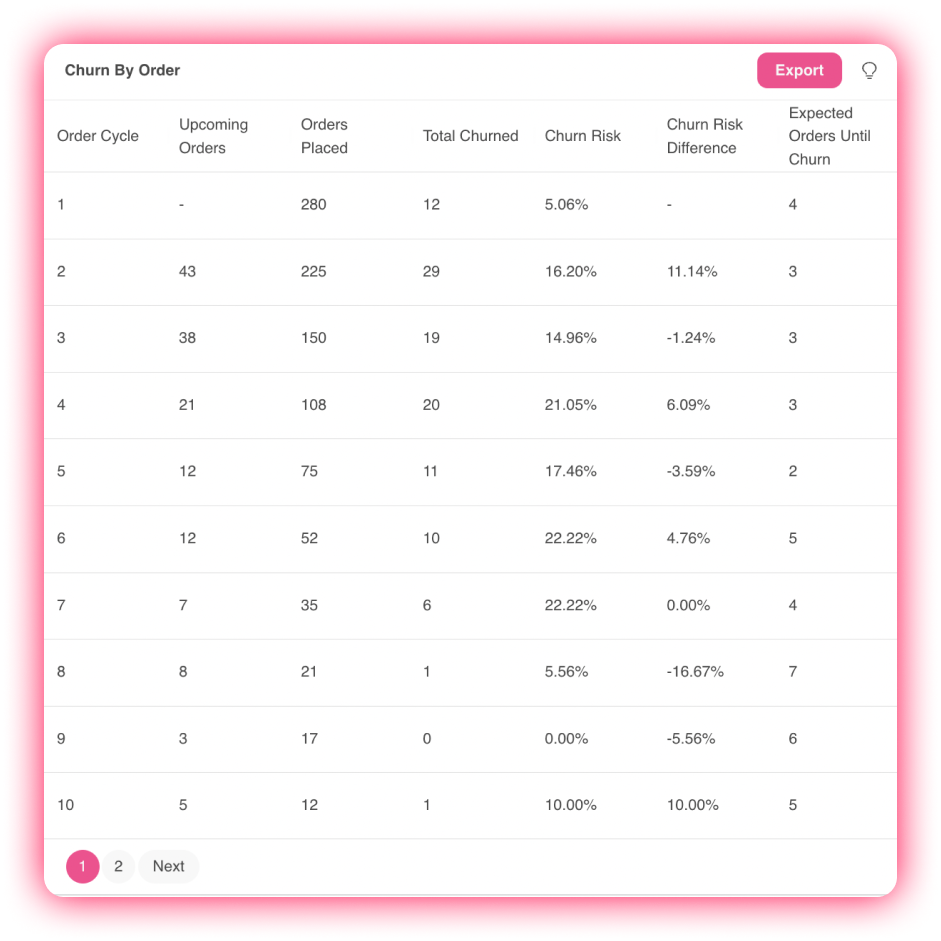

As you kick off your subscription offering, we recommend paying much of your attention to optimizing your offer. You still want to look at acquisition cost, churn rate (when it becomes relevant), and other metrics, but the most important thing is to dial in your offer and who you’re creating it for. Provided you aren’t hemorrhaging money in order to bring people in, it’s okay to focus on really nailing your offering.

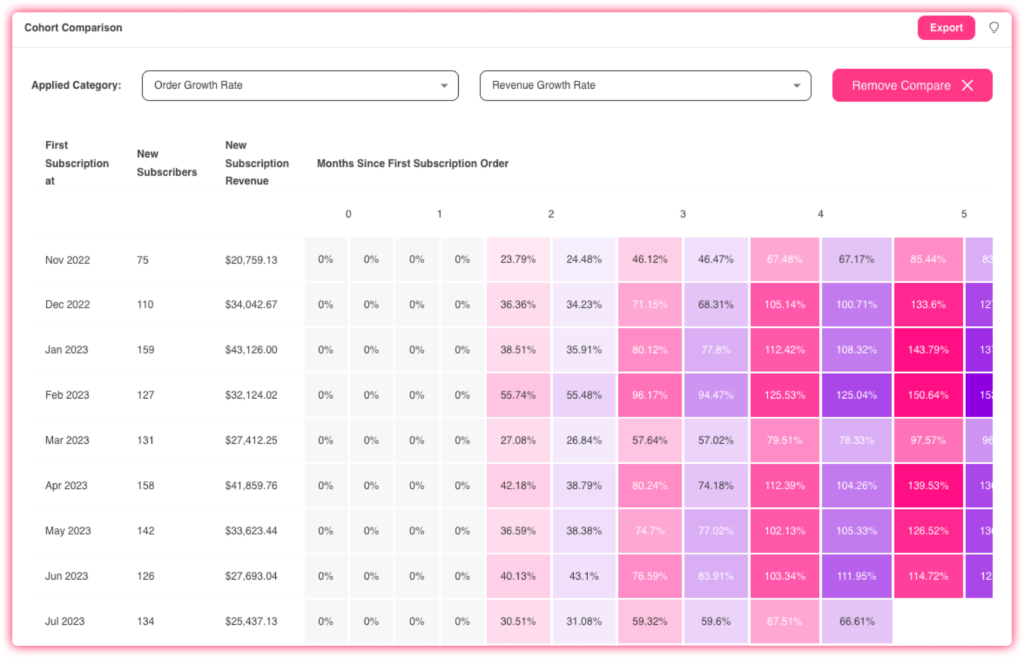

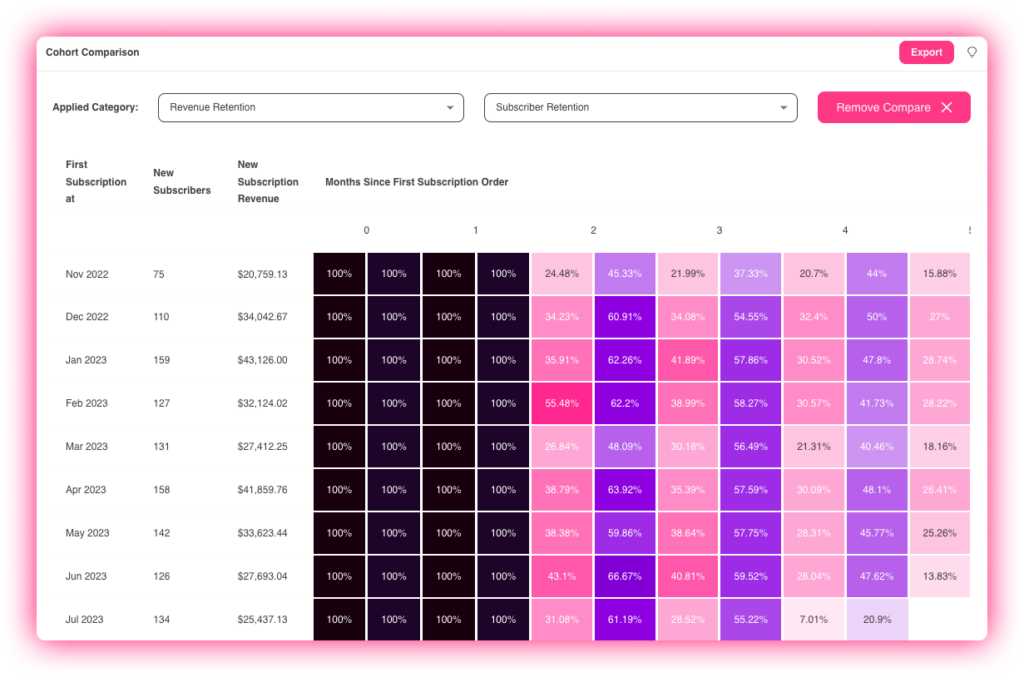

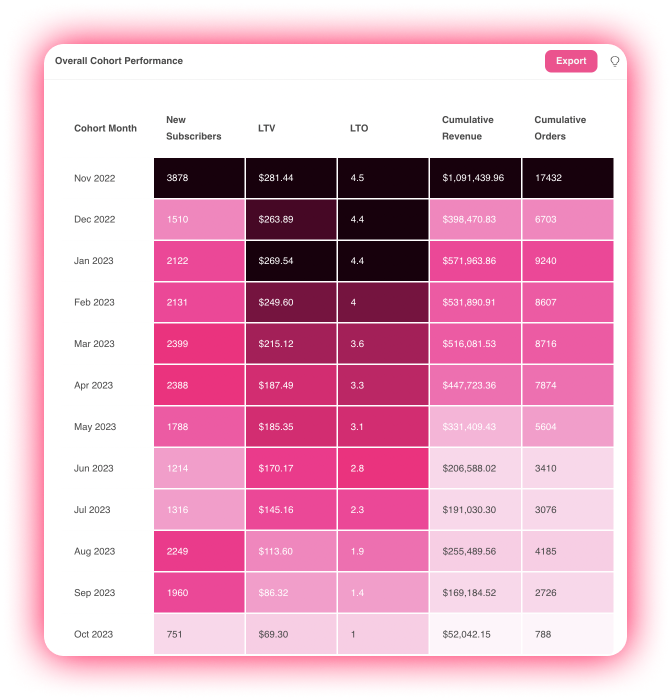

That said, looking at data across each cohort (by timeframe or by product, depending on the KPI) will help you understand how making adjustments to your marketing mix impacts your KPIs. Create an SOP around your data analysis so you can quickly identify trends and change course effectively and efficiently.

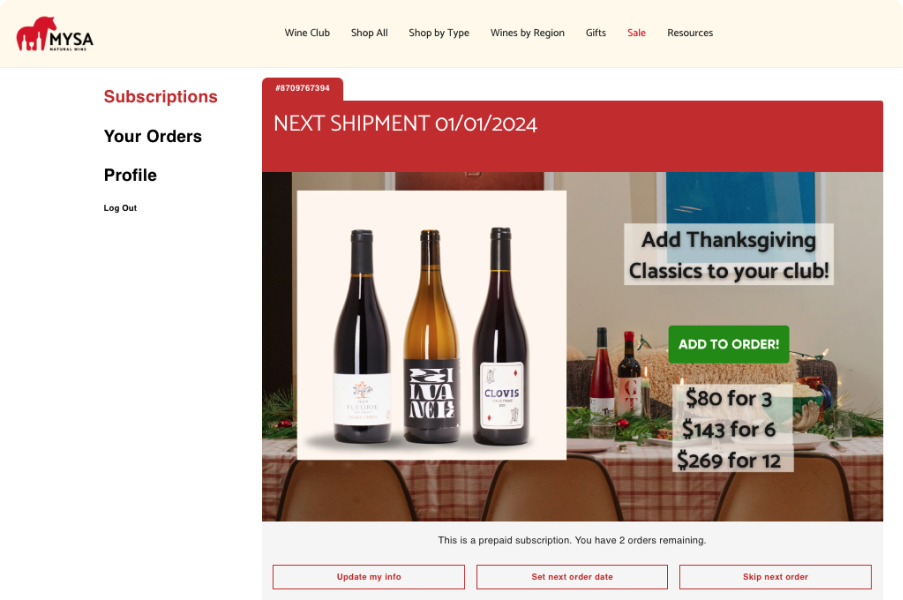

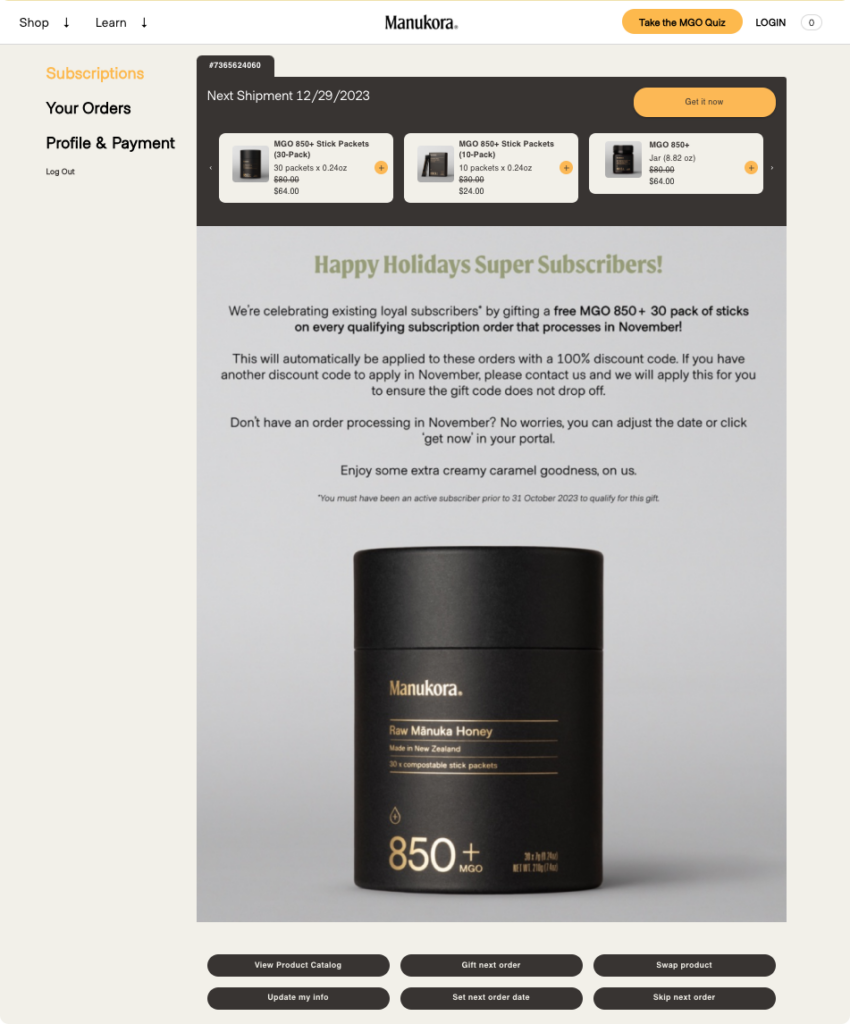

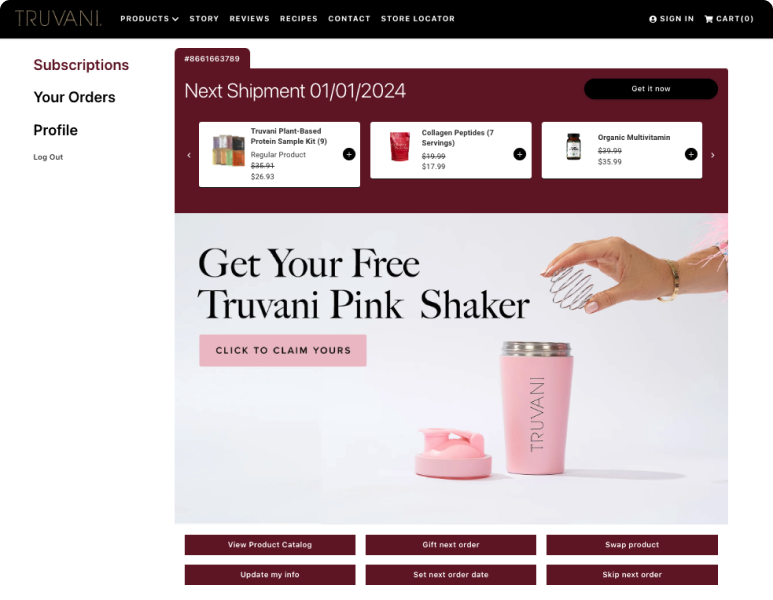

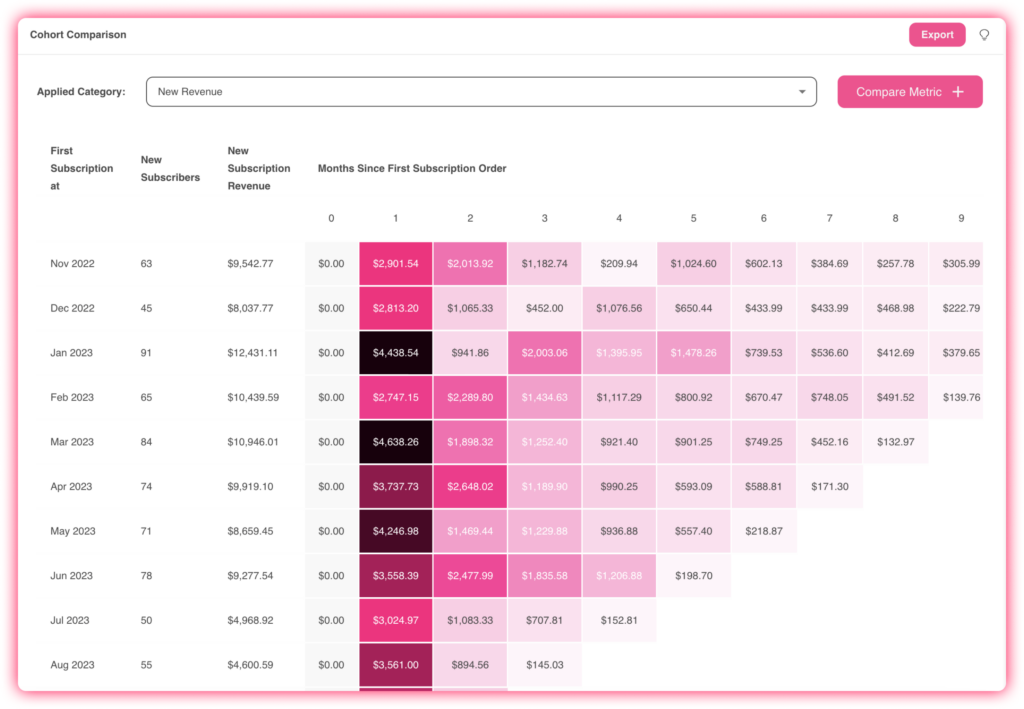

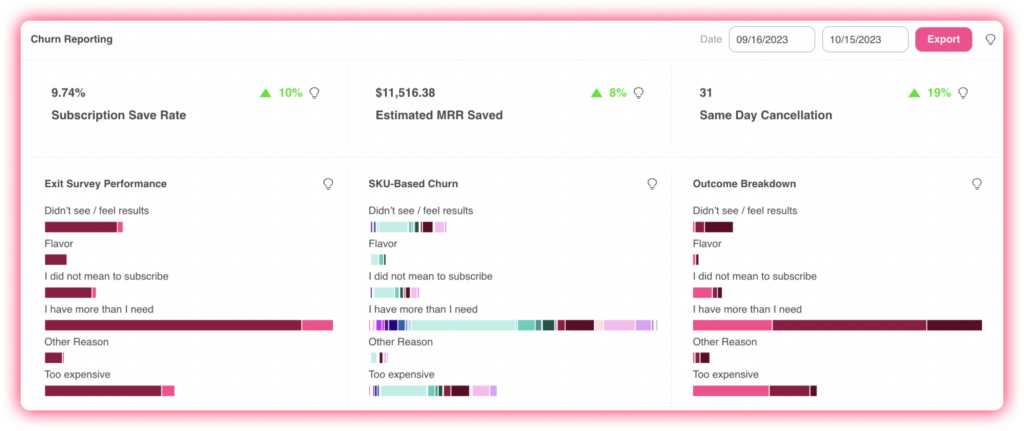

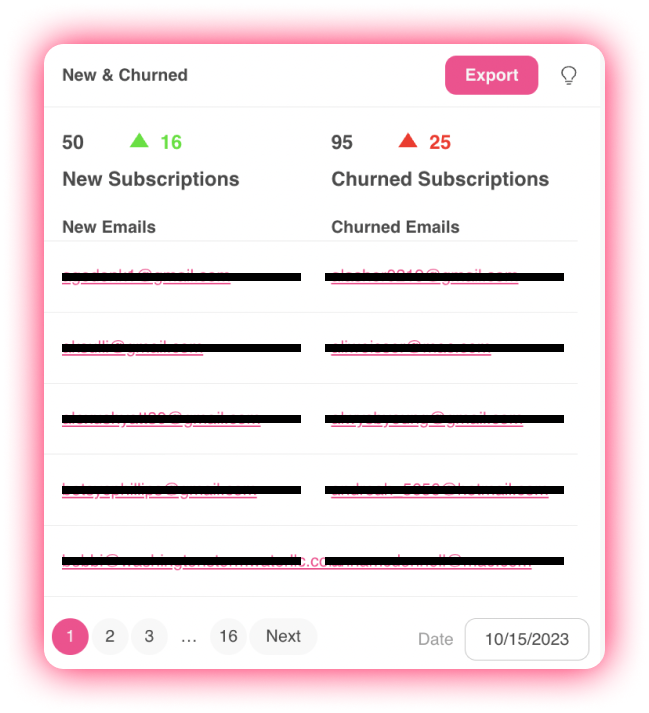

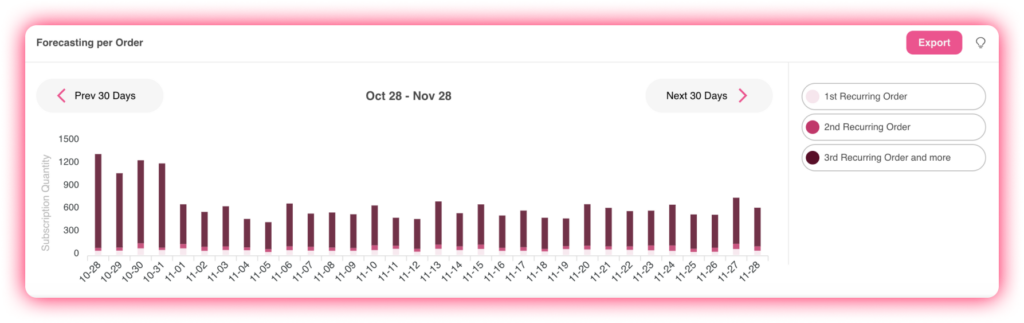

In addition to your ad-specific data, your Stay Ai dashboard will offer key data insights to help you understand how your efforts are performing. You can select the timeframe you want and then see metrics including new subscriptions, revenue, churn, AOV, and average products per order. This will make it easy to see how things change over time so you can focus your energy on the strategies that are working and adjust the ones that aren’t performing as well.

Get Your Products Out There

People who already know and love your products are one thing, but for people who are interacting with your brand for the first time, the idea of setting up a recurring order can be a big ask. If you aren’t getting the traction you’d like on your core subscription offering, it may be worth testing a sample program. Using “just pay shipping” offers, you can introduce people to your products in a way that brings them back for more. Once they’ve had an experience with your product, you can then guide them to your subscription program.

Next Steps

Once you start getting close to 1,000 subscribers, it’s time to start thinking about what it will take to scale up to 10,000 subscribers. Start creating strong SOPs around your customer service and churn analysis so you’re prepared for the influx of new subscribers once you scale up.