Ashvin Melwani Q&A: Maximizing Meta Performance for Subscription Brands

Ashvin Melwani is the cofounder and CMO of Obvi, one of the world’s fastest-growing health and nutrition brands. Since launching in 2019, Obvi has surpassed 250K customers globally while bootstrapping its way to $40m in sales in just 40 months. We sat down to discuss how subscription brands can maximize their Meta strategy.

Q: What do you see as the most important element or tactic to get a first-time prospective customer to convert on a subscription offer?

Ash: I think the subscribe and save model is dying. Most of the time brands are showing a 15% discount if they subscribe, but they also promote a 15% discount on their main pop up. So there really isn’t any incentive to hop on a subscription.

What I do think brands need to do is offer value elsewhere. This can be in the form of free shipping on subscription orders, free gifts with subscription orders, or maybe even access to a private community for subscribers only. I have seen brands also outline certain things they unlock as they progress through their subscription and with Stay.AI a lot of this stuff is possible which is why we love working with this platform.

Q: Do you highlight subscription at all in your ads, or is that messaging saved for post-click? And how do you think about the full purchase journey as it relates to promoting subscriptions?

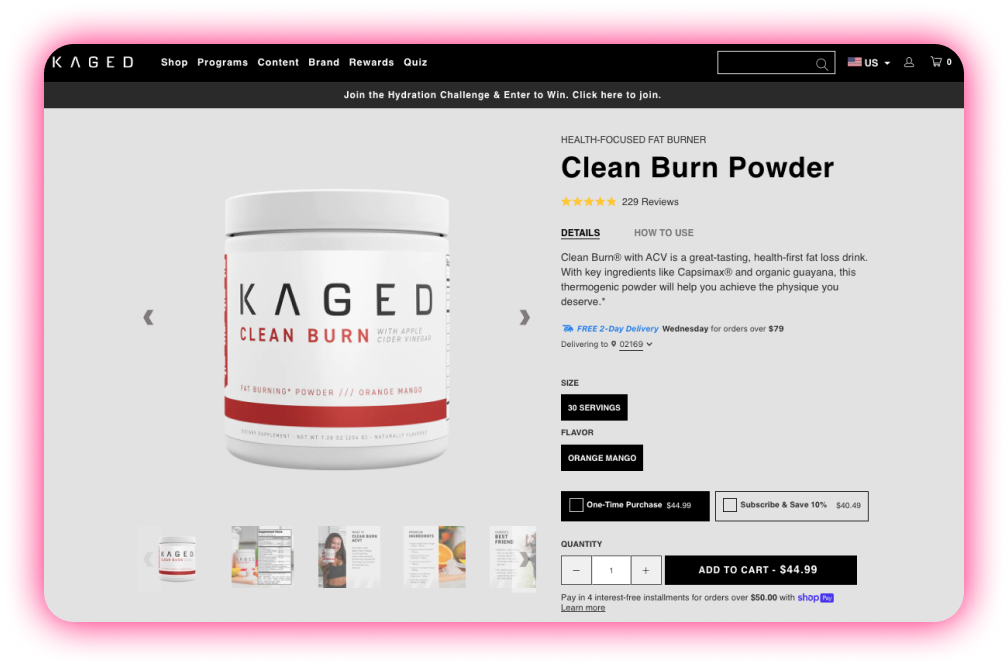

Ash: As of right now we don’t really highlight any mentions of subscriptions in our ads. The messaging in our ads are purely meant to target the right consumer and get them to our website. Then when it comes to landing on our website, that’s where we will do everything we can to sell the product and also give the customer an option for opting in to a subscription or not. We see brands force customers into a subscription and I don’t necessarily agree with this. If the product is good and the brand is relatable, people will naturally opt in if they see value.

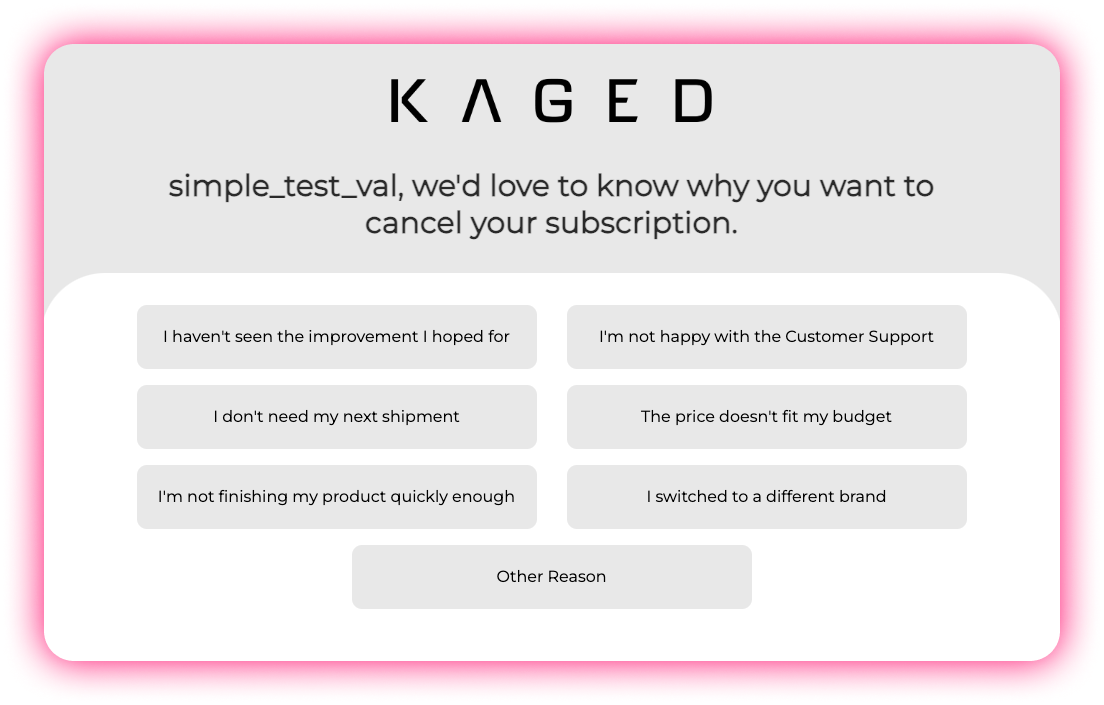

You can definitely use the tactics I mentioned before to highlight the benefits of subscribing on the first order but it’s not the end of the world. In fact I would be weary if you have too many people opt-ing into a subscription for their first order. It might mean you have too high of a discount that people are just taking advantage of. You may see this reflected by a high churn.

Q: Brands are seeing creative have a much higher impact on performance than targeting, calling creative the new targeting. How have you shifted paid social strategy alongside Meta’s constant platform changes and diversification?

Ash: Whether its a video or a static the main goal of our creatives is to do one thing and one thing only: make sure that I can get the RIGHT person to click on my ad and get to my landing page. Sounds obvious but a lot of people are still doing this wrong. They think Meta will do the heavy lifting for you and even while those days are gone, Meta still is king, you just have to give the algorithm better inputs.

Let’s take our static ads for example. Each ad has a massive headline on each one of them. Each headline has the job of attracting the eyeballs of the right person who we believe our product is the best fit for. If we’re able to get the right person to click and engage with our ad, Meta starts to see this as a positive signal and starts to show this ad to similar people. Now if those people start to convert on your landing page that’s an even better signal back to Meta showing them that this experience in general is a positive one and now they’ll start to optimize for the right audience and conversions.

So our entire creative strategy is based on getting the right people to our landing page and really optimizing our landing pages to increase conversion wherever possible.

Q: What unconventional strategies have you experimented with on Meta? Can you share examples of successful campaigns that utilized unique approaches that boosted conversions?

Ash: My whole approach when it comes to Meta, especially now a days, is to leverage Meta to amplify what’s going on in my business.

What I mean by this is I utilize cost caps in all of my campaigns. This allows me to set my target CPA and Meta will only deliver me results if they can hit this target. Now in order for me to scale my ad spend I need to focus on two things. My organic visibility for the brand and improving my conversion rate on my landing pages. If I can introduce TOF traffic and introduce net new eyeballs on my brand and generate that awareness outside of Meta, Meta can now leverage this data and amplify it further by funneling down these people to become buyers by showing them the right ad at the right time. I don’t have to rely on Meta to generate demand and awareness for my brand. This is where I think a lot of people waste their time and money.

The second point being CRO, if I can continuously improve my CVR and Revenue Per Session, I can afford to spend more and account for rising acquisition costs. I am not sure many people think like this but this has been my strategy in 2024.

Q: Recently, you said that one of the easiest ways for brands to increase revenue by 10-15% would be to sell on Amazon. But for DTC brands that offer subscriptions, selling subscription on Amazon can cannibalize direct subscriber sales (on-site) and lead to 3rd party fees and smaller margins from your most loyal customers. That said, how can subscription brands respond to Amazon subscriptions? Is there a way to have the best of both?

Ash: If a customer decides to set up a subscription on Amazon vs your site you have to ask yourself one thing. Would that customer have bought from the website? For us we have seen an incremental lift of 10-20% every time we have products available for purchase on Amazon. If we are doing $50k in revenue per day on the website, and then we send some inventory to Amazon, we’ll start doing an additional $8k-$10k. There are customers who will ONLY shop on Amazon and I want to cater to those people. If I can prove there is incremental revenue, automatically I know that is incremental profit. No matter the margin difference, I do not believe there is cannibalization there!

Q: What tips and tricks can DTC brands leverage today to maximize conversions and impact on Meta?

Ash: There are 3 levers every single operator needs to pull –

- Increase your creative pipeline. Assume that you will have a 10% hit rate on all the new ads you test. If you’re testing 10 ads a week, you can expect MAYBE 1 to hit. If you test 50 ads a week, your odds are finding a winner are way better. Some people may disagree and say they would rather work on 10 quality ads than 50 not so quality ads. To that I say, there is no possible way anyone can accurately predict what is going to work and not work when it comes to creative testing. So test as many things as possible.

- Focus on CRO. Ad costs will continue to rise. It’s an inevitable truth. If you can increase your conversion rate and revenue per session on your website/landing pages at a higher rate than ad costs rise, you will always continue to win. Simple as that.

- Focus on Organic visibility. Work with influencers, build up your own social channels. Don’t rely on paid media to drive awareness for your brand. Use paid media to amplify what’s happening around you. It will make things much much easier for you.

Q: Last but not least, for new DTC brands vs. more established players, how would you allocate acquisition spending to maximize results and move toward breaking even / most quickly achieving profitability?

Ash: I think most brands should aim to be profitable on the first order. It makes life easier. If that means you grow a little bit slower than you’d like then the trade off is a cash healthy business with a solid foundation. If you want to grow quickly and would rather play in to a CAC to LTV model, then make sure you are looking a tight window for LTV. Don’t look at 2 years don’t look at 1 year, maybe look at 6 months but definitely start with 3 months. We cannot predict what the future looks like in 3 months. Macro headwinds, political issues, platform issues, etc. If you are relying on time to make your money back and you can’t guarantee that, then you may end up in trouble. Book the profit first in my opinion!