Last year was a record-breaking BFCM, with merchants raking in over $13 BILLION in revenue and thousands of new subscribers promising more sales in the future.

This is exciting news for most merchants, even despite the light churn of deal-hunters that aren’t ready to stick with subscription long-term. In fact, let’s pause right there. There’s a golden opportunity right now to retain many of those new customers and reduce subscription churn.

It’s all in how you optimize your cancellation survey.

In this article, we’re exploring how to reduce subscription churn by optimizing your cancellation surveys. Ahead, you’ll learn to transform potential churn into continued loyalty, keeping those BFCM subscribers on board for the long haul.

4 subscriber churn metrics every Shopify brand should track

After a big subscriber acquisition or retention event like BFCM, you need to answer a few guiding questions to analyze why customers churned.

- Did our BFCM discounts attract sticky subscribers or just deal-hunters?

- Were there any cancellation survey trends?

- What were the most effective rebuttals for mitigating cancellation?

- When in the customer journey are subscribers churning?

- How many orders did they place, for how long, and for how much before they churned?

- What might have triggered any cancellation trend?

From these answers, you’re trying to understand why your subscribers churned and what’s effectively retaining other customers. With the right data, you can tailor your retention strategies and messages to proactively reduce subscription churn.

The only way to answer those guiding questions is with the correct data and the right metrics to provide that data.

There are four essential subscriber churn metrics you need to calculate:

- Churn by cohort

- Churn rate by product/ SKU

- Churn by cancellation reason

- Customer lifetime value (LTV)

Churn by cohort

This metric measures:

- How long do your subscribers stay subscribed?

- Which products are they canceling most often?

- Churn rate by shipment numbers

- How many subscribers cancel after the first order but before the first recurring shipment?

Churn by Cohort helps you identify drop-off points in your customer lifecycle, allowing you to address these problem areas and reduce subscription churn.

Generally speaking, the most common dropoff point is in the early subscription lifecycle (between the initial order and the first shipment).

Churn rate by product/ SKU

This data can surface patterns in where your customers tend to churn. If you have multiple flavors of one product, for example, and customers churn on one flavor more often than the others, you should feature the preferred flavors more prominently in your product catalog.

Churn by cancellation reason

Understanding why your customers leave is crucial to proactively preventing and reducing subscription churn. Exploring the various reasons – whether it’s pricing, product dissatisfaction, or insufficient deals on favorite items – empowers you to make informed changes that enhance customer satisfaction and retention.

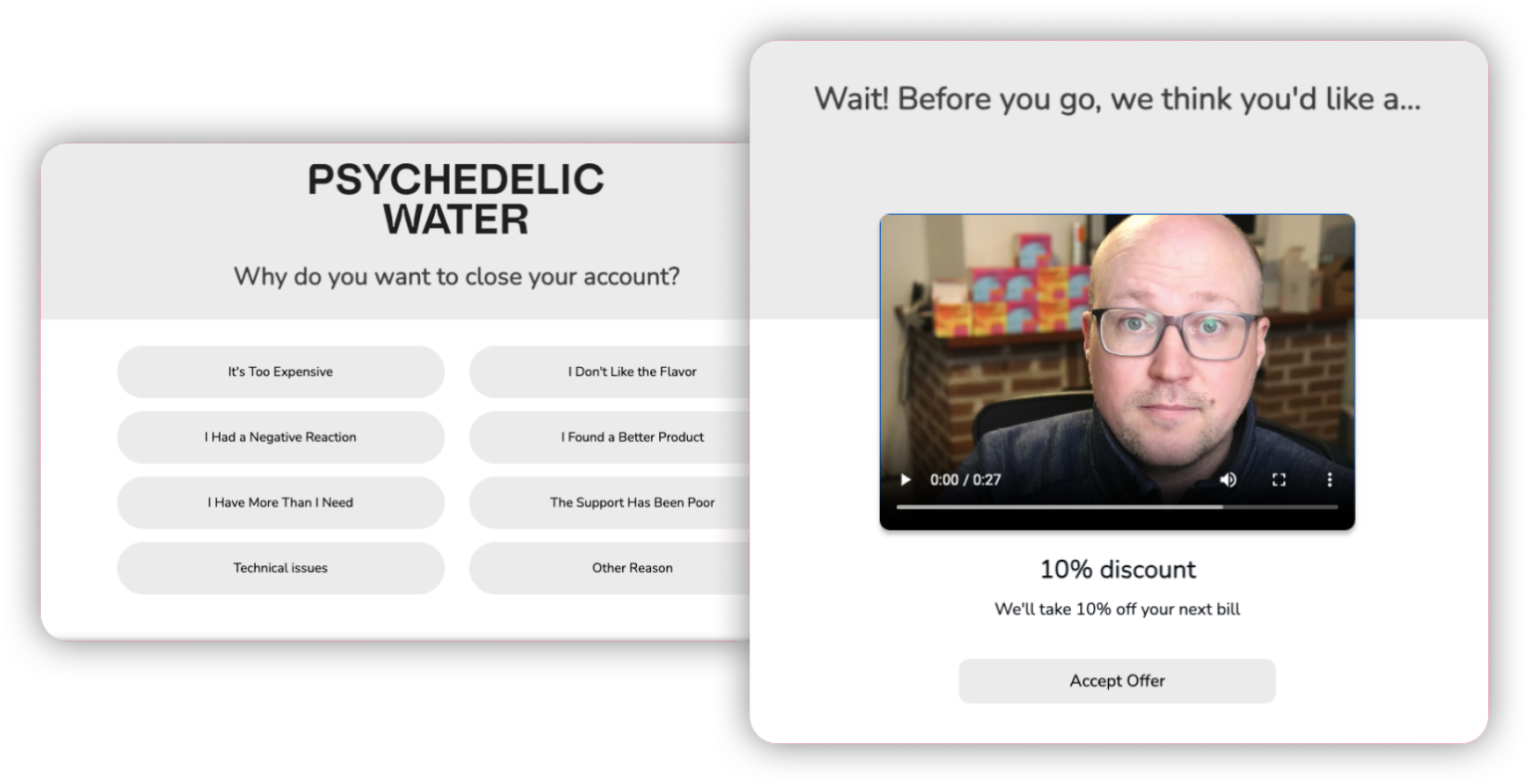

Psychedelic Water expected subscribers to churn because of pricing reasons. But after reviewing their cancellation survey data, they realized that customers often cited “too much product” as their reason for cancelling. To address this concern earlier in the funnel and reduce subscription churn, the team introduced messaging into their post-purchase flows around how to use and consume their product, giving customers more reasons to consume it (and less reasons to cancel because of excess product). The result? A 14% increase in subscription save rate.

Customer lifetime value (LTV)

How valuable is each customer over the lifetime of their subscription? No matter the number, it must be high enough to make a significant return on investment. Otherwise, some tweaks to your subscription program might be in order.

How to reduce subscription churn after BFCM

Now that you’re equipped with the right metrics for analyzing performance, let’s dive into actual strategies for reducing subscriber churn.

Adjust your cancellation survey for new subscriber segments

While most brands can’t avoid the bargain shoppers that aren’t ready to be long-term subscribers, you can still capture valuable insights from their exit by optimizing your cancellation surveys.

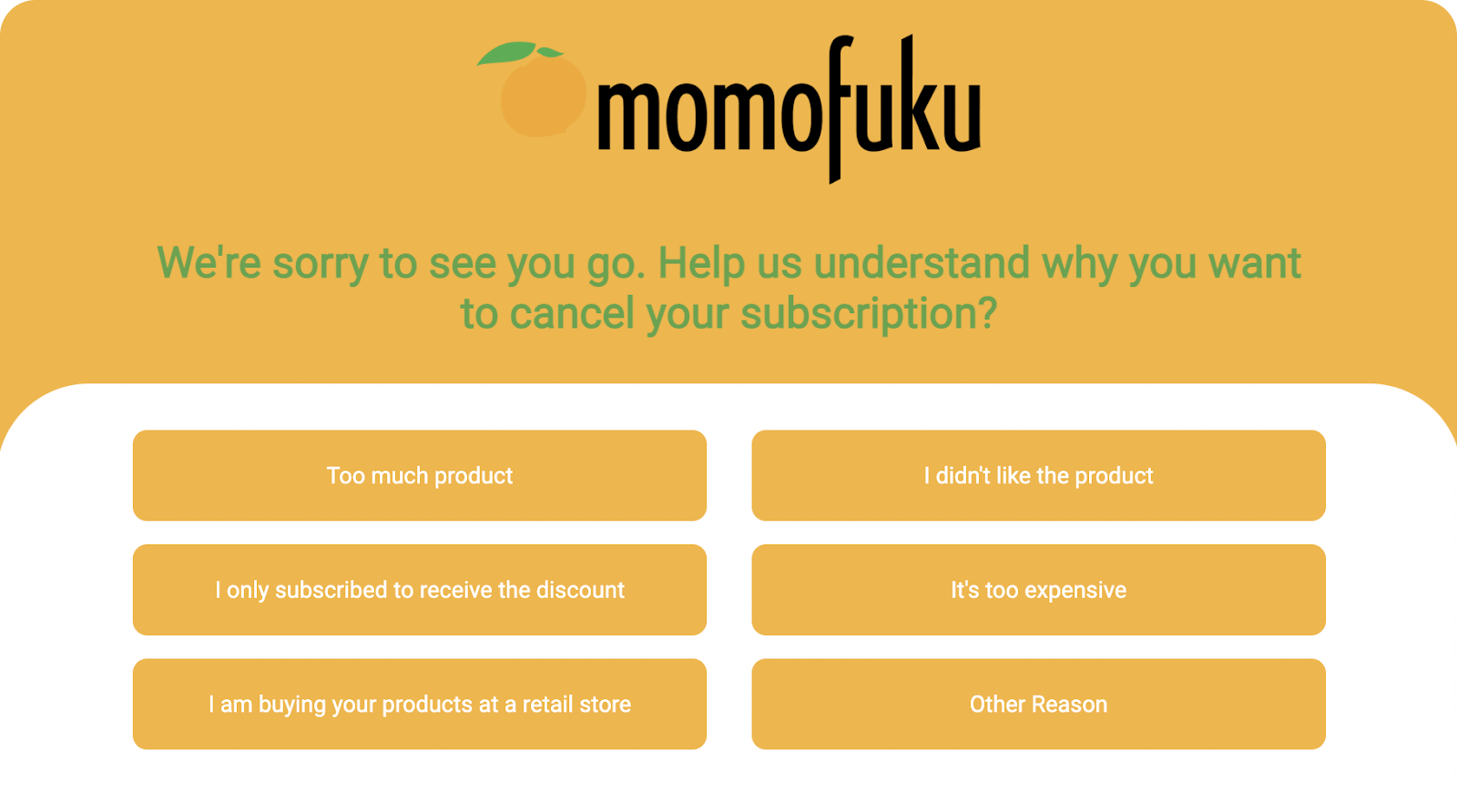

During sitewide sale events like BFCM, you can add cancellation survey options that directly address the bargain-hunting cohort, like:

- “I just signed up for the discount”

- “I found better prices somewhere else”

Adding options like these helps you segment your audience between the high-churn deal-hunters and higher-LTV subscribers. Then you can focus your attention on strategies to reduce subscription churn with the more loyal cohort (if not win those customers back).

Momofuku’s cancellation survey allows them to segment their audience between deal shoppers and new customers with more long-term LTV potential.

Optimize cancellation survey options dynamically

Ask several customers for their reasons for canceling and use that information to create more standard options in your cancellation survey. Alternatively, start with a few core options and adjust them over time based on the data.

For instance, you might start with “price” as a major reason for subscriber churn, but this could break down further into “I can’t afford this right now,” “I was looking for a discount,” or “It’s not worth the price.”

More specific reasons could alter your response. If it were a temporary affordability issue, you could pause their subscription for a set period rather than cancel altogether. If it were a perception of value issue, you could offer a free product or a discount.

Understanding the issue can help you reduce subscription churn and proactively prevent it in the future.

Address your “other” category

If customers choose “other” on your surveys more than 5% of the time, add the option to comment on their reasoning. You might find patterns in their answers and adjust your selections.

You can also temporarily disable the “other” selection after adjusting your cancellation survey to see which options are driving the highest subscriber churn rates.

Avoid recency and primary bias

Randomizing the order of your cancellation survey options can help reduce subscription churn and improve the accuracy of the data. It’ll protect you from primacy bias, the likelihood you’ll remember the first items on a list better than those in the middle. It’s also a strategy for addressing recency bias, which is the greater likelihood that you’ll remember more recent information better.

Create cancellation rebuttal offers that help reduce subscription churn

Making them an offer that’s too good to refuse…is essentially the key to retaining your customers when they’re on the brink of cancellation. The only way to do that is to tailor your offer to counter their reason for leaving.

Olipop is an excellent example of this. They used Stay’s Retention Engine to optimize their cancellation surveys and tailor rebuttal offers on the subscriber level based on cancellation reason. From discounts for price objections to highlighting the ease of swapping when customers claim they want to try different flavors, Olipop gives a masterclass in creating cancellation treatments that reduce subscription churn. In fact, their survey strategy led to a 26% reduction in active churn.

When subscribers answer your cancellation surveys, they’re offering personal data that you can use to optimize your responses to their cancellations. A machine learning tool like Stay’s RetentionEngine is the only way to analyze all those insights, find patterns within their answers, and instantly customize offers to attempt to retain your customers in the moment of churn.

Get ahead of subscriber churn with segmentation and personalization

Many brands expect a level of churn around the holidays, especially since most companies focus more on bringing in new customers versus retaining their existing ones. You can avoid the loss of both the new customers you bring in and your existing customer base with the right segmentation and promotions.

Take the cue from Vita Coco, who decided to give their existing subscribers an even greater discount than incoming customers to proactively reduce subscription churn during BFCM.

First, they segmented their existing subscribers from their holiday promotion emails to offer them a discount on their next order. They offered first-time shoppers a separate promotion, but one less advantageous than becoming a long-term subscriber and maintaining that subscription.

This meant that their new customers received a discount, and their existing customers were incentivized to stay. 11% more of their new subscribers retained their subscriptions. They never even had a chance to reach their cancellation survey!

Reduce subscription churn automatically

Black Friday and Cyber Monday may bring a lot of deal hunters to your checkout portal. But there are dozens of ways to delight them into staying with you, even if they reach that cancellation survey.

You just need the ability to collect and analyze their feedback to provide personalized deals. The best way to do that is with Stay’s RetentionEngine, which uses AI to continuously optimize your cancellation survey and serve personalized treatments that have been proven to save customers.

Want to learn more about reducing subscription churn with Stay AI, the leading Shopify subscription app? Book a demo today.

FAQs

Subscription churn is the rate at which subscribers cancel or end their recurring orders over a specific period. It shows how many customers a brand is losing and helps identify patterns that impact long-term retention. Understanding this data is crucial for identifying effective strategies to reduce subscription churn through approaches like enhanced experiences, personalized offers, and optimized cancellation surveys.

You can reduce subscription churn by understanding why subscribers leave and addressing those reasons with targeted retention tactics, such as optimized cancellation surveys and personalized rebuttal offers. Analyzing churn by cohort, product, and cancellation reason helps surface patterns that guide more effective interventions. Brands that segment their audience and tailor experiences proactively see the biggest lift in reducing subscription churn.

BFCM often attracts deal-focused shoppers who subscribe solely for discounts, leading to higher subscriber churn in the weeks that follow. To reduce subscription churn after BFCM, brands should segment discount-driven subscribers using clear cancellation survey options and tailor retention strategies, like personalized offers or education flow, to keep potentially high-LTV customers engaged.

To effectively reduce subscription churn, brands should track key metrics like churn by cohort, churn rate by product/SKU, churn by cancellation reason, and customer lifetime value (LTV). These insights reveal where customers are dropping off and why, allowing teams to optimize messaging, product presentation, and retention flows based on real behavioral signals.

A well-optimized cancellation survey is one of the most effective tools for understanding and reducing subscription churn. By offering specific cancellation reasons (e.g., “I only signed up for the discount” or “Too much product”), brands can identify trends, personalize rebuttal offers, and proactively improve the subscriber experience. Dynamic survey options also allow teams to gather better data and address churn earlier.