Without optimized dunning settings, you could be leaving money on the table.

It’s critical to keep an eye on payment failures and optimize your dunning settings, so you can maximize customer LTV.

First – let’s talk failed payments. Failed payments typically occur when a customer’s credit card expires or their card declines. Payments can also fail if the customer’s selected subscription product(s) are out of stock.

When a payment fails, dunning settings come to save the day. They’re the set of a rules a system runs for responding to, and actioning on, failed payments.

Dunning setting rules dictate:

- how often you retry a payment method (i.e. – every X days)

- how many times you retry that payment method (i.e. – X total times)

- and lastly, whether or not the subscription should be cancelled after X total processing attempts.

So, why does this matter?

Too many failed attempts can impact your business. When Stripe, for example, sees a ton of failed payment attempts, they might think your business is up to something sketchy. Brands with high payment failure rates run the risk of being flagged by payment processors.

It impacts your customer experience. Depending on your settings and customer comm triggers, your subscriber might not realize their card expired/declined – leaving them to wonder why they haven’t gotten their favorite flavor of chips this month. This can lead to confused or grumpy customers, as well as more CX tickets in the queue.

You could be leaving money on the table. This is especially relevant when it comes to product out-of-stocks. If you aren’t notifying customers that their subscription product(s) are out of stock, it can impact their customer experience and inspire a cancellation. And if you don’t let customers know that you’re out of stock, you miss giving them the opportunity to swap their product(s) or agree to a partial order fulfillment.

Your subscription data gets wonky. So many brands neglect to cancel a customer’s subscription after X failed payment attempts, even after giving up on running the card. If that’s the case, when you dig in to your data, you’ll see an inflated number of “active subscriptions” — even if those folks haven’t been a legitimately active subscriber in months. We’ve seen this discrepancy as high as the thousands. For accurate forecasting and planning, you need the cleanest data possible – and cancelling those folks who are not actually paying for their subscriptions helps keep your numbers in check.

Failed Payments & Dunning Settings Best Practices: Recommendations

First, look at your Dunning settings: Check how frequently you retry cards, how many times you retry them, and (if anything), what happens after that. Here’s what our team has found in terms of best practices:

- Trigger payment failure reminders every 6 days

- Set your number of retries to 6

- Cancel the subscription after those retries have been exhausted

Here’s what that looks like inside Stay:

After selecting these settings, make sure to adjust your email triggers accordingly. If you’re seeing a lot of card declines, we recommend setting up an auto-trigger email with a Klaviyo quick action directly to the customer portal, encouraging subscribers to update their billing.

Check out this example from Alleyoop below:

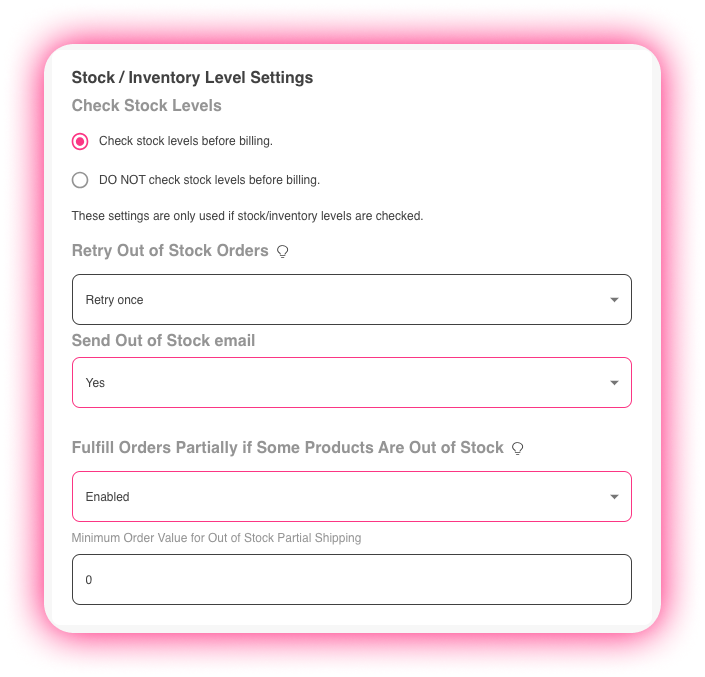

Next, make sure to dictate how product stock should impact your billing. We recommend enabling “check product stock before billing”, sending customers notifications when products are out of stock, and enabling partial order fulfillment.

Here’s how that looks in Stay:

We also recommend setting up auto-trigger emails encouraging subscribers to swap their OOS product for something else.

Here’s an example email from Medterra:

Wrapping it up…

TLDR: Failed payments and dunning settings are no joke! Dig into that data, tinker with those settings, and maximize that LTV.